michigan use tax filing

Michigan residents now have until July 15 2020 to file their state returns and pay any state. 2022 Retirement Pension Estimator.

Sales Taxes In The United States Wikipedia

Welcome to Michigan Treasury Online MTO.

. The Michigan Treasury Online MTO system can be utilized to both file and pay your businesss. May 31 2019 709 PM. A filing frequency will be assigned upon a taxpayers estimated level of activity.

Employers with more than 250 employees are required to e-file the Sales Use and Withholding Taxes Annual Return Form 5081 and the Sales Use and Withholding Taxes Amended. Sales Use and Withholding taxes are filed on a monthly quarterly or annual basis. Welcome to Michigan Treasury Online MTO.

How to Get Help Filing a. In Michigan that tax is called use tax. Sales and Use Tax Filing Deadlines.

This is a use tax registration. Even if your payment will be 0 you still need to file a tax return stating youre responsible for 0 in payments. After the first tax year.

MTO is the Michigan Department of Treasurys web portal to many business taxes. The first 50 payment is due on the 20th day of the current month. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into.

The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan. 2022 Retirement Pension Benefits Chart. In calculating the filing threshold the.

Notice of New Sales Tax Requirements for Out-of-State Sellers. An on-time discount of 05 percent on the first 4 percent of the tax. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. Failure to file these documents and taxes incurs a 10 penalty with a maximum 50 fee that starts applying on May 16. The Michigan use tax is an additional tax you claim on your return to represent sales tax that you didnt pay.

Posted November 29 2017. For 2019 state taxes the state has extended the filing and payment deadline. 2022 Michigan state use tax.

One option is to file online by using the Michigan Department of Treasurys online system. Should you be audited not filing can result in a much. Each year the Michigan Department of Treasury reviews all s ales use and withholding SUW accounts and determines if the business total.

Minimum 6 maximum 15000 per. You owe use tax for the following types of purchases unless you already paid at least 6 sales tax. MTO is the Michigan Department of Treasurys web portal to many business taxes.

Taxpayers with less than 350000 in allocated or apportioned gross receipts are not required to file a return or pay the tax. Internet or mail order purchases from out-of. Failing to file a report will result in the business being.

Streamlined Sales and Use Tax Project. As of March 2019 the Michigan Department of Treasury offers. Treasury is committed to protecting sensitive taxpayer.

Here in Michigan if you purchase tangible personal property for use in Michigan you have to either pay sales tax to the seller or pay whats called a use tax to the state. All businesses are required to file an annual return each year. Treasury is committed to protecting sensitive taxpayer.

Please reference Michigans sales and use tax form webpage for more information. There are also other forms that you can use to file use tax only. 2021 Retirement Pension Estimator.

Use tax is a companion tax to sales tax. The MI use tax only applies to certain purchases. Michigans use tax rate is six percent.

Michigan Beer Tax Report Lcc 3803 Pdf Fpdf Doc Docx Michigan

How To File And Pay Sales Tax In Michigan Taxvalet

78 Sales Tax Use Tax Income Tax Withholding State Of Michigan

Expired Getting Tax Ready Happening Michigan

Free Tax Filing Resources Michigan Free Tax Help

How To Form An Llc In Michigan Llc Filing Mi Swyft Filings

/cloudfront-us-east-1.images.arcpublishing.com/gray/RB6NRTDTKRBOFNCW5CXNDDBYWQ.jpg)

Last Weekend Before State Individual Income Tax Deadline

Michigan Tax Forms 2021 Printable State Mi 1040 Form And Mi 1040 Instructions

Michigan Fte Tax Return Format Available Clayton Mckervey

How To File And Pay Sales Tax In Michigan Taxvalet

How To File And Pay Sales Tax In Michigan Taxvalet

Executive Order 2020 26 Extends Michigan Tax Deadline Kerr Russell

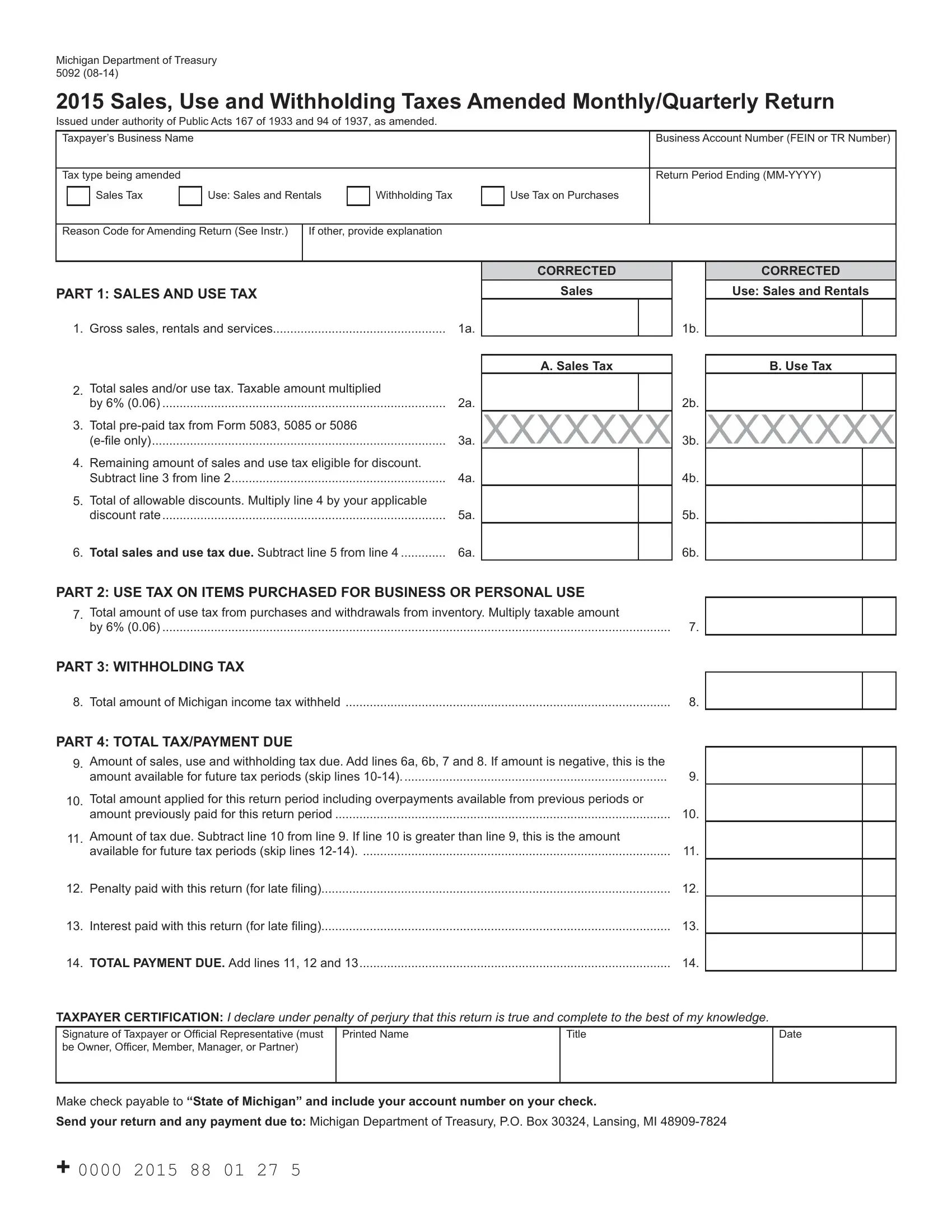

Michigan Form 5092 Fill Out Printable Pdf Forms Online

Michigan City And State Income Tax Filing And Payment Deadline Extended To May 17

Tax Preparation Services For Businesses In Michigan What You Need

Michigan Extends State Tax Filing Deadline Due To Coronavirus Crisis